We Represent Wool Brokers The National Council of Wool Selling Brokers of Australia is the only national organisation representing wool brokers on all issues that affect the Australian wool industry. Read more about NCWSBA

Since 1919 The NCWSBA has represented the interests of Australian wool brokers since 1919 and is recognised by all in the industry within Australia and internationally and by governments in Australia. Read more about NCWSBA

Wool Brokers are Agents for Woolgrowers 85-90% of all wool sold in Australia is sold at auction by wool brokers, who act as the agents for woolgrowers. Read more about NCWSBA

Australia-wide Our members account for over 80% of wool sold at auction in Australia and come from all states of Australia, including Australia’s largest wool brokers. Read more about NCWSBA

We Represent Wool Brokers The National Council of Wool Selling Brokers of Australia is the only national organisation representing wool brokers on all issues that affect the Australian wool industry. Read more about NCWSBA

Since 1919 The NCWSBA has represented the interests of Australian wool brokers since 1919 and is recognised by all in the industry within Australia and internationally and by governments in Australia. Read more about NCWSBA

Wool Brokers are Agents for Woolgrowers 85-90% of all wool sold in Australia is sold at auction by wool brokers, who act as the agents for woolgrowers. Read more about NCWSBA

Australia-wide Our members account for over 80% of wool sold at auction in Australia and come from all states of Australia, including Australia’s largest wool brokers. Read more about NCWSBA

LATEST NCWSBA AND INDUSTRY NEWS

NCWSBA President's Report 2023

NCWSBA appoints Robert Herrmann as Executive Director

Finalists Announced for NCWSBA 2022 Wool Broker Award

NCWSBA Wool Broker Award Launched for 2022

PAUL DEANE APPOINTED AS NCWSBA EXECUTIVE DIRECTOR

Global economy on the recovery path, but uncertainties remain

NCWSBA Wool Broker Award Launched for 2021

Wool exports rise for Australia, NZ and South Africa, down for South American countries

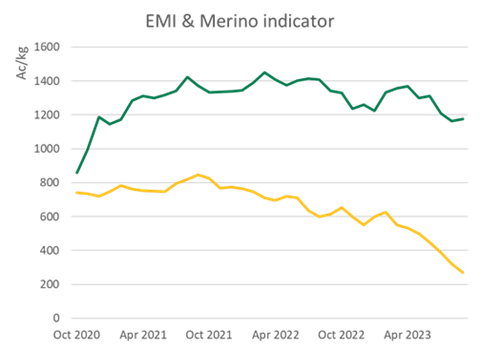

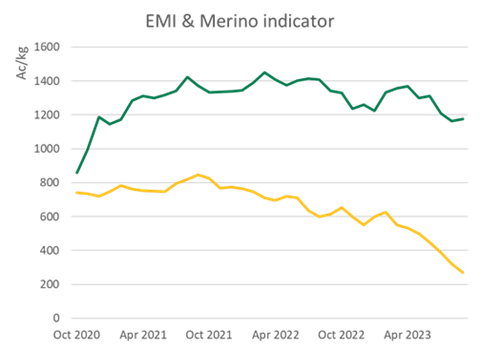

Wool prices lag the rise in general commodity prices

Latest X Posts

NCWSBA Logo Welcome

The National Council of Wool Selling Brokers of Australia

The National Council of Wool Selling Brokers of Australia was first established in 1919 to represent the interests of Australian wool brokers. It has continued this role uninterrupted for over 100 years, ensuring that wool brokers are heard on all major wool industry issues within Australia and internationally.

The NCWSBA is an Incorporated Association. It is a founding member of the Federation of Australian Wool Organisations, and has representatives on key Australian wool industry organisations and committees.